when are draftkings tax forms available

Click to see full answer. Players who believe that funds held by or their accounts with DraftKings Inc.

Hindenburg Report Targets Draftkings Takes Short Position

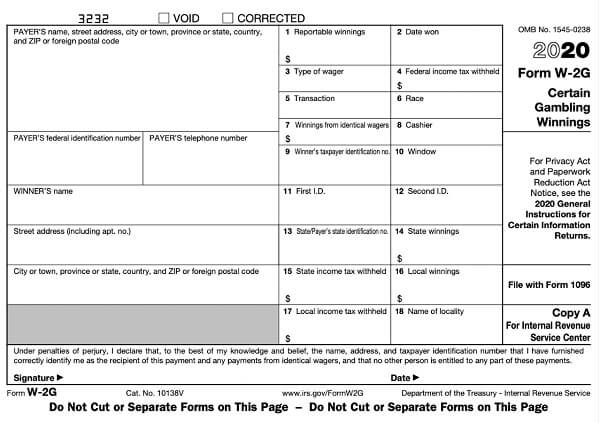

Key tax dates for DraftKings - 2021 Where can I find my DraftKings tax forms documents 1099 W-2G.

. Tax form on DraftKings. This article covers how you get your DraftKings sportsbook tax form in addition to how you fill in your DraftKings tax form. Draftkings 1099 form for 2021.

We will withhold federal income tax from the winnings if the winnings minus the wager exceed 5000 and the winnings are at least 300 times the wager. Users will be able to visit the Website and view the games eg sportsbook and casino offered by DraftKings and available to play and place a wager the Game or collectively the Games. SPORTS Live Sports Betting Odds.

6 rows Forms 1099-MISC and Forms W-2G will become available online prior to the end of February IRS. This material has been prepared for informational purposes only and. We should mention that most bettors should have received their DraftKings 1099 forms in the mail after February 1st.

For Oregon activity please contact the DraftKings Customer Support team as the information in this article may not apply to you. If you receive your winnings through PayPal. Have been misallocated compromised or otherwise mishandled may register a complaint with DraftKings Inc.

Hillfamily5 4 years ago. If you qualify to receive tax forms from DraftKings IRS Forms 1099W-2G you can access the information directly from the Document Center. Most players should have received after February 1st but if you havent received yours there is another way to retrieve yours online at the DraftKings Document Center.

Why am I being asked to fill out an IRS Form W-9 for DraftKings. How do I update personal information on my tax forms 1099-Misc W-2G for DraftKings. To understand how an NFT sale will affect you during tax preparation DraftKings suggests that you consult with a tax professional.

Once you are logged in click on your name in the top right and go to My Account from the drop-down box. Still waiting for your DraftKings 1099 forms in the mail. The most exciting place to experience The Sweat.

Key tax dates for DraftKings - 2021 Where can I find my DraftKings tax forms documents 1099 W-2G. Has anyone heard any updates on draftkings releasing the 1099 forms this year. We will issue a W-2G form each time a player has a payout of 600 or more no reduction for the wagered amount and a return that is 300X the amount wagered.

You can log on to your account to find your form today. This week alone Ive won 5000. 1099s are usually sent by the end of January but many still wait for their DraftKings 1099 forms which support has been saying will arrive in 2-4 weeks.

Our Team is available 24 hours a day 7 days a week. Easy to jump in 247365. Anyone know when they are usually available in the tax document area on the site.

Steps to Retrieve Your DraftKings 1099 Forms. However if you havent received yours dont worry. The only place I see where a 1099-MISC is applicable is Small Business Self employed which is not what my DRAFTKINGS form is from.

A customers first deposit min. As sports begin a slow return daily fantasy sports companies like DraftKings could potentially owe millions more in taxes due to new government guidance on tax rules. 5 qualifies the user to receive up to 500 in bonus funds in the form of site credits that can only be used.

Why am I being asked to fill out an IRS Form W-9 for DraftKings. Live Dealer games available. Our Team is available 24 hours a day 7 days a week.

Click on Document Center which you will see on the left hand side of this page. Ive read they usually ask for an extension but I have not seen any updates. Andor appropriate tax forms and forms of identification including but not limited to a Drivers License Proof of Residence andor any information.

You may be required to pay both federal and state income tax. Normally I withdraw my money with no issue but Draftkings is making me fill out a form for taxesanyone else having to do this. Depending on the actual state you live in DraftKings will report your winnings after a certain amount.

Fantasy sports winnings of at least 600 are reported to the IRS. You can expect to receive your tax forms no later than February 28. I think you have to do one after 600 profit.

Jokerswild22 4 years ago. If it turns out to be your lucky day and you take home a net profit of 600 or more for the year playing on websites such as DraftKings and FanDuel the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC. Good news they are available for download online.

No DraftKings doesnt report Marketplace transactions to the IRS and wont issue tax forms for any Marketplace transactions at this time. Please advise as to where I input this other income that is not considered gambling however it was gambling winnings. Once on this page you see a variety of account related items.

How do I update personal information on my tax forms 1099-Misc W-2G for DraftKings.

/cdn.vox-cdn.com/uploads/chorus_asset/file/22778751/DK_Nation_1800x1200_6.png)

Nft Explained What Are Nfts And How Do They Work In The Draftkings Marketplace Draftkings Nation

Draftkings Sportsbook Florida 2022 Promotions And Preview

Goldman Sachs Says Put Your Money On Draftkings Penn National

Draftkings And Live Betting Expected To Change Wm Phoenix Open Experience Phoenix Business Journal

Draftkings 22 4b Shopping Spree Front Office Sports

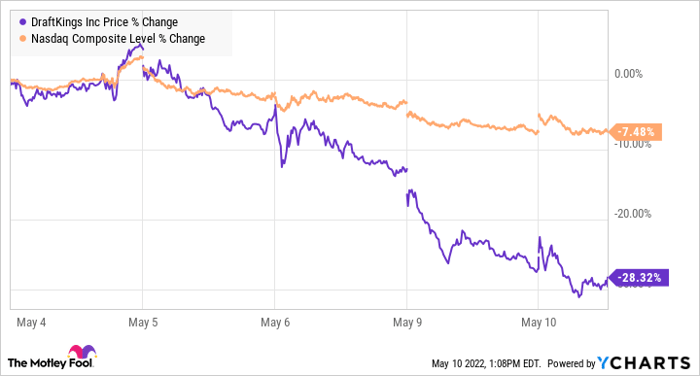

Why Draftkings Stock Was Down Again Today Nasdaq

Draftkings Tax Form 1099 Where To Find It How To Fill

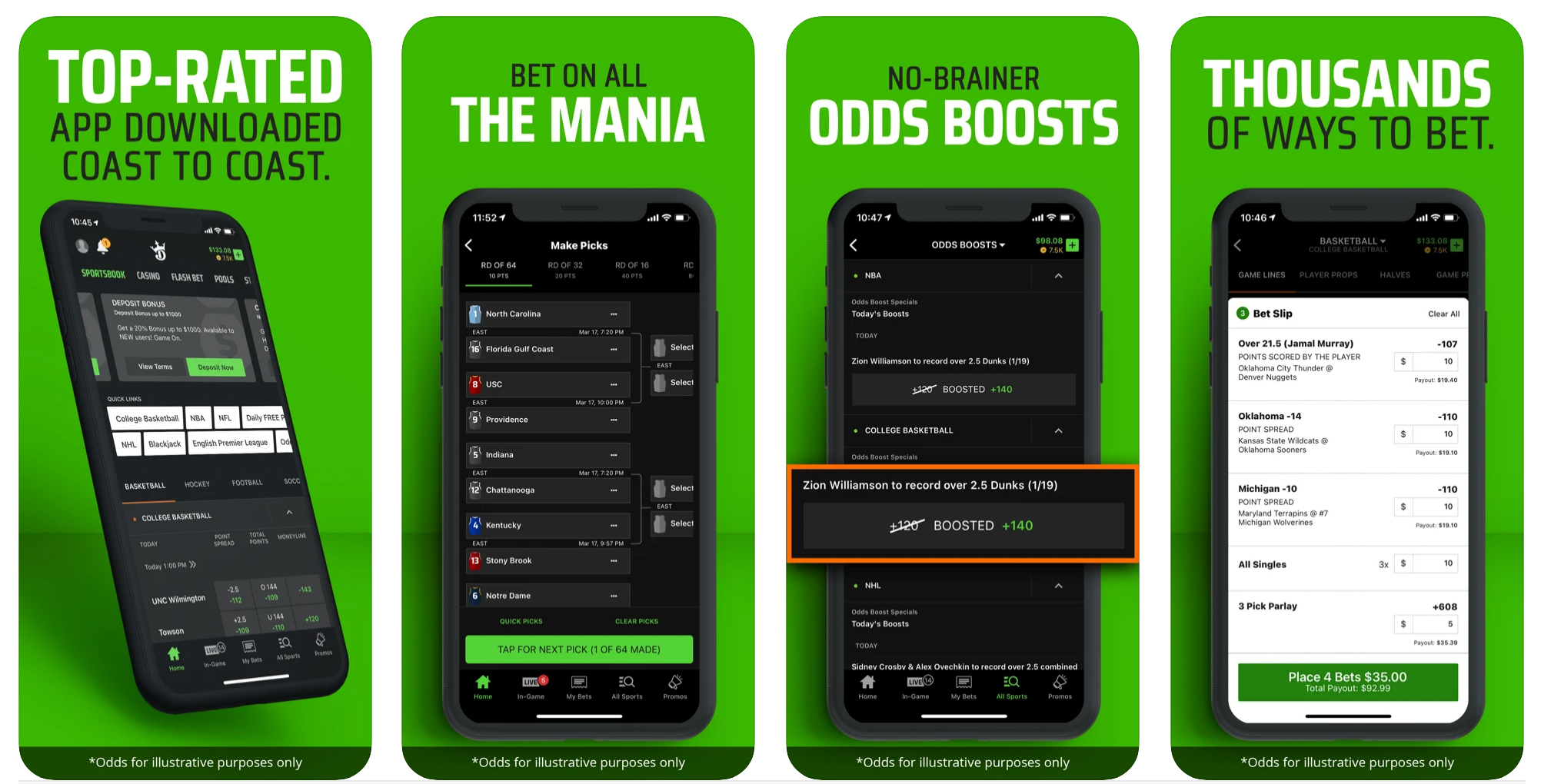

Draftkings Online Sportsbook App Review Best Offers In Ny La Az

Draftkings Sportsbook Ohio The Best Sports Betting App Coming Soon

Jason Robins Sees Strong Draftkings 2022 Despite Stock Market Jitters Sportico Com

Draftkings App Review Risk Free Bet Up To 1 050 Free

Draftkings Sportsbook Colorado A Phenomenal Sports Betting App

Don T Go Bargain Hunting On Draftkings Stock Quite Yet Says Analyst

Draftkings Canada Ontario Sportsbook App Promo Code

Draftkings Tax Form 1099 Where To Find It How To Fill

Draftkings Fanduel Legal States Where Is Dfs Allowed

Draftkings Sportsbook Review Why It S The Best Online Sportsbook Crossing Broad